Formats

Online Live Classes

Real-time interactive lessons with an instructor

Schedule: Twice weekly, 1 hour per session

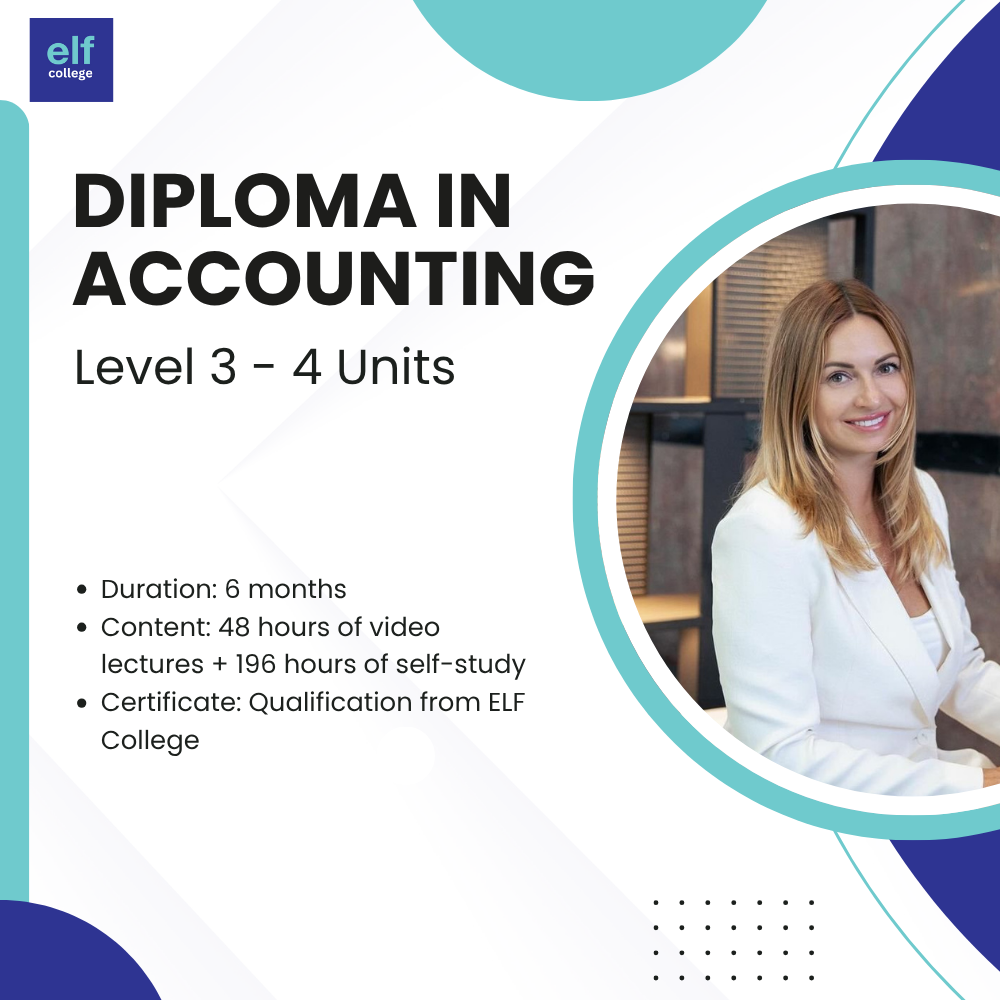

Duration: 6 months (full qualification)

Live Q&A and direct feedback

Guided support throughout the course

On-Demand Self-Study

Study anytime with full flexibility

Access 24/7 for 12 months

Pre-recorded lessons featuring real classroom examples

Ideal for independent learners

Career Benefits

This qualification is ideal for those who want to:

Progress into accounting or finance roles

Gain skills needed for accounts assistant, finance officer, bookkeeper and payroll support roles

Build a solid foundation for AAT Level 4 Diploma in Professional Accounting

Increase earning potential and employability

Understand both financial and managerial aspects of accounting

Entry Requirements

Learners can enrol with or without previous accounting experience.

Recommended: Level 2 accounting or equivalent knowledge.

Strong English and numeracy skills are essential.

Who This Course Is For

Accounting assistants progressing to higher-level responsibilities

Bookkeepers expanding into financial and management accounting

Career changers entering the accounting profession

Students preparing for Level 4 or chartered accounting pathways

Next Steps

After completing Level 3, learners can progress directly to:

AAT Level 4 Diploma in Professional Accounting, covering advanced taxation, financial statements for limited companies, and management accounting.